Velo3D, a specialist in metal 3D printing, has announced financial results for the first quarter of its fiscal year ending March 31, 2023. Revenue for the first quarter was $26.8 million, an increase of 120% year-over-year. Gross margin for the first quarter was 10.9%, an improvement of approximately 500 basis points from the prior quarter. Net loss for the quarter was $36.2 million.

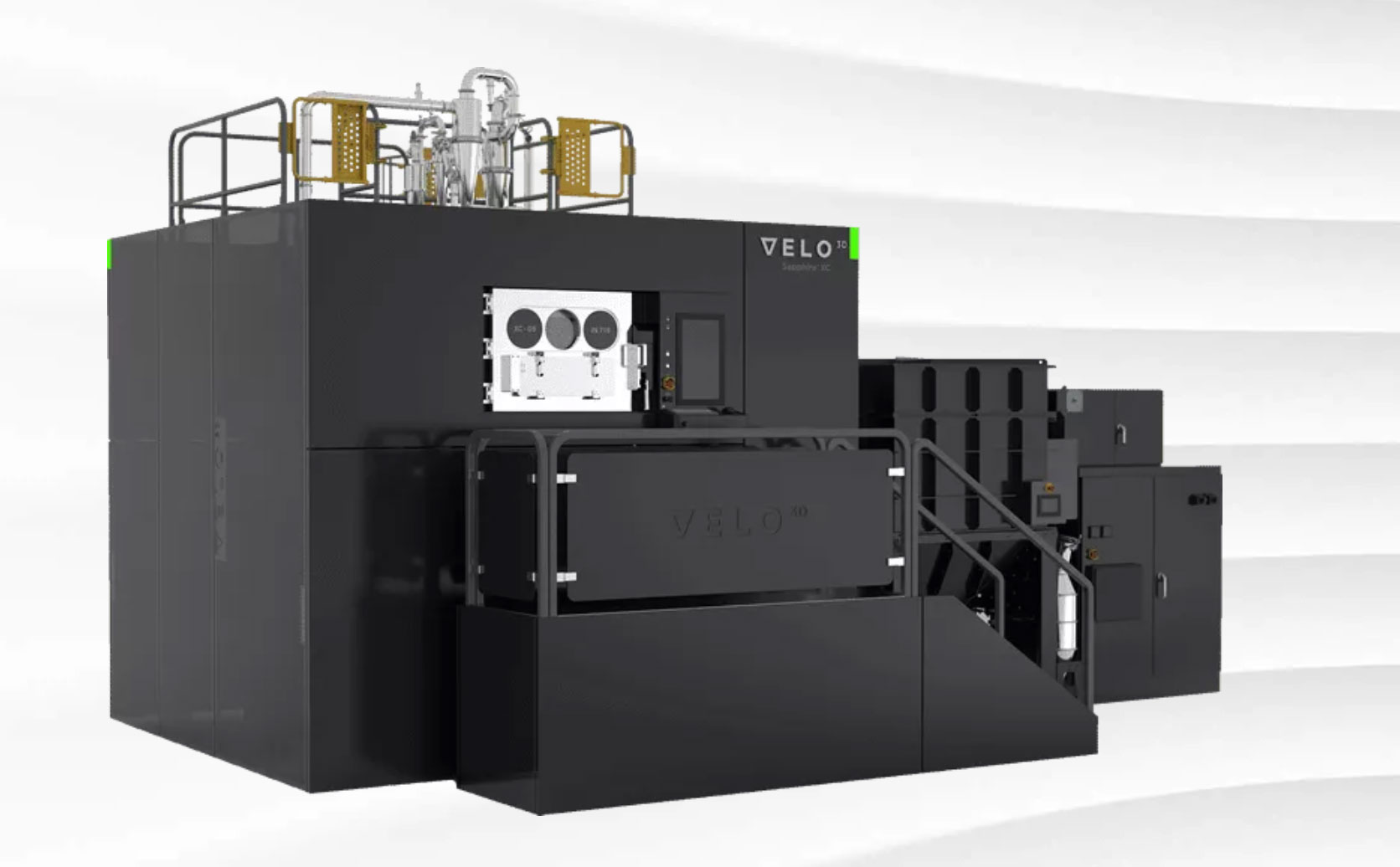

“We were pleased with our results as continued demand for our industry leading Sapphire platform, combined with strong manufacturing execution, enabled us to achieve our first quarter forecasts,” said Benny Buller, CEO of Velo3D. “Operationally, we continued to successfully ramp our Sapphire XC and Sapphire XC 1MZ production in order to meet the increasing demand from both new and existing customers for these systems. Importantly, we significantly improved our gross margin for the quarter as we are starting to see the initial benefits our recently implemented operational efficiency initiatives to reduce production costs and improve system manufacturing cycle times. Additionally, our operating expense reduction initiatives are on plan and we remain confident in meeting our goal of a 20% reduction in year over year fourth quarter Non-GAAP operating expenses. Overall, our first quarter success reflects the increasing acceptance of our technology as more customers turn to Velo3D to manufacture the critical, high value metal parts they need.”

“Looking forward, demand remains strong as bookings rose more than 30% sequentially to $20 million and our backlog now totals $24 million. With 75% of our second quarter revenue either booked, recurring or in backlog, we have increasing confidence in our ability to achieve revenue growth of more than 50% this year. Finally, we continue to successfully execute on our 2023 strategic priorities and our path to profitability remains clear. Given our first quarter results, increasing demand for our leading technology and strong industry fundamentals, we remain confident in our ability to achieve our 2023 operational and financial goals,” concluded Buller.

Summary of First Quarter 2023 results

Revenue for the first quarter was $26.8 million, an increase of 120% year over year. Compared to the first quarter of 2022, Year of Sale revenue[1] improvement was driven by an increase in system volume and a higher average selling price due to a more favorable transaction mix. On a sequential basis, Year of Sale revenue declined primarily due to slightly lower system volume as the fourth quarter included shipments deferred from the third quarter, and a lower average selling price reflecting the absence of deferred payment transactions compared to the fourth quarter. Support service and recurring payment revenue rose 10% to $2.2 million compared to the first quarter of 2022, primarily due to an increase in the company’s installed base.

Gross margin for the first quarter was 10.9%, up approximately 500 basis points sequentially, as the company benefited from a sequential reduction in material costs and improved manufacturing efficiency. Labor and overhead costs for the first quarter were in line with forecasts and the company expects further improvement in its material costs through the end of 2023.

Operating expenses for the first quarter increased 14% to $27.0 million compared to $23.7 million in the fourth quarter of 2022. Fourth quarter operating expenses included $3.4 million of non-recurring expense reductions, primarily in research and development. On a comparable basis, excluding these non-recurring expenses, operating expenses were in line sequentially. Non-GAAP operating expenses, which excludes stock-based compensation expense of $6.2 million, was $20.8 million. Excluding the aforementioned $3.4 million non-recurring benefit from the fourth quarter, first quarter operating expenses declined approximately 5% sequentially.

Net loss for the quarter was $36.2 million and reflected a loss of $12.2 million on the fair value of warrants and contingent earnout liabilities. Non-GAAP net loss, which excludes, among other items, the gain on fair value of warrants and contingent earnout liabilities as well as stock-based compensation expense, was $17.8 million in the three months ended March 31, 2023. Adjusted EBITDA for the quarter, excluding the same metrics, was a loss of $16.0 million. For more information regarding the company’s non-GAAP financial measures, see “Non-GAAP Financial Information” below.

The company ended the quarter with a strong balance sheet with $64 million in cash and investments and minimal debt. Net cash flow for the quarter improved more than 50% sequentially and was ahead of guidance. The company expects sequential improvement in cash flow through the balance of the year while approaching break even in the fourth quarter of 2023.

Guidance

Given strong demand trends, current backlog and first quarter bookings, the company is confident in achieving its 2023 financial forecasts.

For the second quarter of 2023, the company expects the following:

- Revenue in the range of $25 million to $29 million

- Gross margin in the range of 12% to 16%, assuming no impact from potential non-recurring charges

- Bookings in the range of $23 million to $29 million

For the fiscal year 2023, the company’s guidance remains unchanged:

- Revenue in the range of $120 million to $130 million

- Gross margin in the range of 19% to 21%, assuming no impact from potential non-recurring charges – with gross margin of approximately 30% in the fourth quarter of 2023

- Bookings in the range of $100 million to $130 million

For more information about Velo3D, please visit velo3d.com.

Subscribe to our Newsletter

3DPResso is a weekly newsletter that links to the most exciting global stories from the 3D printing and additive manufacturing industry.