Velo3D, Inc. (NYSE: VLD), an additive manufacturing technology company for mission-critical metal parts, announced financial results for its second fiscal quarter of 2022.

“Our tremendous success in providing our customers with the industry leading additive manufacturing solutions they need is reflected in our revenue growth, increasing more than 15 fold since the first quarter of 2021,” said Benny Buller, CEO of Velo3D. “We have accomplished this while the revenue of our peers has been relatively flat over the same period. As a result, given our expected strength of our business in the second half of the year, it is possible that we will be the industry leader in metal additive manufacturing as we exit 2022, quicker than even we anticipated.”

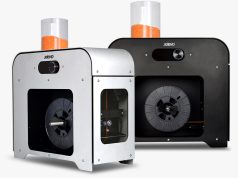

“Demand for our industry-leading Sapphire family of systems remains high as we booked $18 million in new orders during the quarter and exited the quarter with $55 million in total backlog. As a result of this strong demand, we now have significant visibility in achieving our revenue guidance this year as more than 95% of our 2022 revenue forecast is now either recognized, booked or recurring revenue. We also expanded our product leadership during the quarter with the recent launch of our Sapphire XC 1MZ. With part sizes up to 10 cubic feet, we believe this is the world’s largest commercially available metal powder bed fusion production system with initial customer shipments commencing this quarter,” continued Buller.

“Looking forward, given our first half execution, strong second quarter bookings, revenue visibility through our backlog and the further scaling of Sapphire XC production, we are very confident in our ability to meet our 2022 revenue guidance of $89 million,” concluded Buller.

| ($ in Millions, except percentages and per-share data) | 2nd Quarter 2022 | 1st Quarter 2022 | 2nd Quarter 2021 |

| GAAP revenue | $19.6 | $12.2 | $7.1 |

| GAAP gross margin | 6.3% | 0% | 30.6% |

| GAAP net income (loss) | $128.0 | ($65.3) | ($12.5) |

| GAAP net income (loss) per diluted share | $0.63 | ($0.36) | ($0.78) |

| Non-GAAP net loss | ($21.0) | ($23.1) | ($10.0) |

| Non-GAAP net loss per diluted share2 | ($0.10) | ($0.13) | ($0.62) |

| Cash and Investments | $142 | $186 | $12 |

Information about Velo3d’s use of non-GAAP information, including a reconciliation to U.S. GAAP, is available at https://ir.velo3d.com/.

- Reconciliations to U.S. generally accepted accounting principles (GAAP) financial measures are presented below under “Non-GAAP Financial Information”.

- Non-GAAP net loss and non-GAAP net loss per diluted share exclude stock-based compensation expense, and fair value adjustments for the Company’s warrants and earnout liabilities.

Summary of Second Quarter 2022 results

Revenue for the second quarter was $19.6 million, an increase of 60% compared to the first quarter of 2022 and more than 160% year over year. The company shipped 7 systems in the second quarter. The improvement in revenue was primarily driven by a more favorable mix of Sapphire XC system sales resulting in an increase in average selling price. Recurring revenue was in line with forecasts and is expected to increase in the second half of 2022 due to the higher number of systems in the field.

Gross margin for the quarter was 6% and continues to reflect the impact of launch customer pricing for the company’s Sapphire XC systems shipped during the quarter as well as elevated overhead absorption and bill of materials costs as the company scales its manufacturing operations. While the company’s gross margin for the second quarter was in line with expectations, ongoing supply chain challenges have changed the timing of certain forecasted cost reduction benefits that will impact gross margin in the second half of the year. Bill of material cost savings, which were anticipated for the second half of 2022, are now expected to be delayed until the first half of 2023 as the company reduces pre-purchased, higher cost inventory acquired in the first half of 2022 to offset ongoing component shortages and delivery delays.

Additionally, these challenges will impact the delivery schedule of its remaining launch customer systems with certain shipments shifting to the third and fourth quarter resulting in more gross margin impact in those quarters than initially forecasted. The company continues to expect its per unit labor and overhead costs to be in line with its plan due to its manufacturing scale up. As a result, the company now expects its third quarter gross margin to be in line with its second quarter gross margin and fourth quarter 2022 gross margin to be in the range of 11% to 14%.

Operating expenses for the quarter declined slightly to $27.5 million, primarily as a result of lower general and administrative costs partially offset by higher sales and marketing expenses to fund the company’s global expansion plans. Non-GAAP operating expenses, which excluded stock-based compensation expense of $5.0 million, was $22.5 million.

Net income for the quarter was $128 million and reflected a gain of $154 million on the fair value of warrants and contingent liabilities. Non-GAAP net loss, which excludes the gain on fair value of warrants and contingent earnout liabilities as well as stock-based compensation, was $21.0 million. Adjusted EBITDA for the quarter, excluding the same metrics, was a loss of $19.8 million. For more information regarding the company’s non-GAAP financial measures, see “Non-GAAP Financial Information” below.

The company ended the quarter with a strong balance sheet with $142 million in cash and investments. As a result, the company believes it has the liquidity for ongoing technology investments as well as providing the resources needed to fund its growth plans.

Guidance

For fiscal year 2022, given its strong year to date results and significant backlog, the company is reiterating is previous revenue guidance of $89 million.

Additional information for fiscal year 2022:

- The company’s business continues to evolve due to new product introductions and changing customer demand trends

- The company booked $18 million in new orders in the second quarter and has a total backlog of $55 million

- More than 95% of the company’s 2022 sales forecast is either recognized, booked or expected recurring revenue

- Product mix – the company is observing significantly higher average selling prices due to increased Sapphire XC product demand which is expected to offset a lower unit count than forecasted

- End customer mix – the company expects to continue to see a material shift in mix towards higher recurring purchasing rates from existing customer for 2022 than in the initial model

The company’s conference call for investors will be webcast and can be accessed from the Events page of the Investor Relations section of Velo3D’s website at https://ir.velo3d.com/.

For more information, please visit velo3d.com.

Subscribe to our Newsletter

3DPResso is a weekly newsletter that links to the most exciting global stories from the 3D printing and additive manufacturing industry.