According to a recent analysis by market research company CONTEXT, there were significant regional differences in 3D printer shipment figures in the second quarter of 2023. While suppliers from East Asia, especially China, recorded strong growth, the figures for Western manufacturers fell.

China installed 38% of all industrial 3D printers shipped in the second quarter. This was driven primarily by domestic suppliers such as UnionTech, which increased its unit shipments by 66% year-on-year. Western companies, on the other hand, recorded a 15% drop. In terms of market size, China is followed by North America (29%) and Western Europe (23%).

According to CONTEXT, there is a trend toward more powerful metal 3D printers with more lasers. Here, Chinese manufacturers such as BLT (Xi’an Bright Laser), Farsoon, Eplus3D and HBD have recently entered the “laser war”. Although unit sales have fallen in some cases, CONTEXT expects sales growth from the more expensive models.

Shipments of midrange printers increased 7% year-over-year and 2% quarter-over-quarter in Q2 2023. This is largely due to sales of a subclass of low-end polymer powder bed melters (most of them from Formlabs) and rising domestic shipments of resin printers in China (almost exclusively from UnionTech): When UnionTech and Formlabs are excluded from the analysis, midrange shipments declined -17% year-over-year. Formlabs’ current success is largely due to the creation of a new category, but shipments of these devices are now starting to stagnate.

The Professional price category continued to struggle with weak shipments. Shipments in Q2 2023 were down 30% year-over-year, following a similarly dramatic decline in the previous quarter. Systems using both leading processes were affected: FDM/FFF printer shipments were down -36%, while SLA printer shipments were down -30%. Both market leaders UltiMaker BV (owner of the Ultimaker and MakerBot brands) and Formlabs saw sharp year-on-year declines in shipments of products in this class.

The personal printer price class saw growth in both unit sales (+12% year-on-year) and system sales (22% year-on-year) during the period, thanks exclusively to Bambu Lab and AnkerMake. Bambu Lab has taken the personal 3D printer market by storm and was the market leader in this class of fully assembled personal printers this quarter. However, if these two companies are excluded, overall 3D printer sales fell 28% year-over-year. Although former market leader Creality saw a slight increase in shipments of its models in the personal class, most vendors saw double-digit year-over-year declines in shipments.

Creality continues to dominate the lower regions of the 3D printer market and remains the undisputed market leader in the DIY Kit&Hobby class, where the reported 4% increase in shipments fueled growth, while other vendors’ sales declined (e.g., Prusa Research shipments fell -7% year-over-year).

Outlook

Half of the top ten 3D printers by revenue that cost more than $2,500 – EOS, UnionTech, HP, Velo3D and Nikon SLM Solutions – saw at least some year-over-year shipment growth in the first half of 2023. However, other companies such as Stratasys, Desktop Metal, UltiMaker, 3D Systems and Formlabs saw shipments decline in the first half of the year.

“These companies have equally mixed, varied and conflicting outlooks, reflecting the wide differences in macroeconomic forecasts,” said Chris Connery. “Many suppliers are dealing with longer sales cycles, some are facing a backlog of orders, while others point to strong demand in the second quarter of 2023; some are pointing to early signs of recovery, while others still see the global economic environment as challenging and uncertain. What is certain is that interest rates remain high globally and the cost of capital continues to limit spending on new hardware for many potential buyers.”

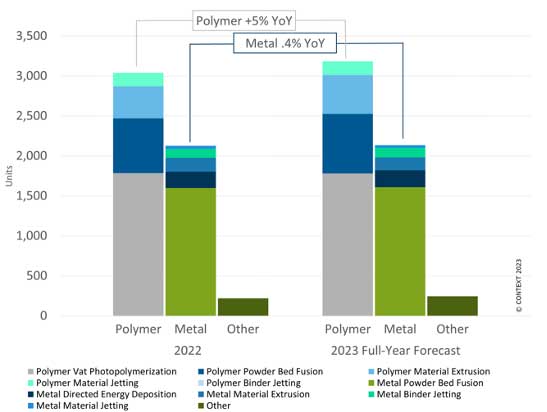

Taking into account all regions, all material types and all printer modalities, full-year forecasts now point to low single-digit unit growth (3%), but mid-teens system sales growth (14%). Looking at the leading industrial price category, unit shipments of industrial polymers are expected to grow by 5%, while sales are expected to increase by 9% year-on-year, mainly due to inflation-related price increases from 2022. Shipments of industrial metal printers are expected to be more or less flat (up just 0.4% year over year), but the shift to more expensive, efficient multilaser metal powder bed fusion systems around the world is expected to amplify the impact of inflation and lead to 15% sales growth for the full year, CONTEXT said.

Subscribe to our Newsletter

3DPresso is a weekly newsletter that links to the most exciting global stories from the 3D printing and additive manufacturing industry.