3D Systems Corporation (NYSE:DDD) announced its financial results for the second quarter ended June 30, 2022.

Second Quarter Financial and Operational Results

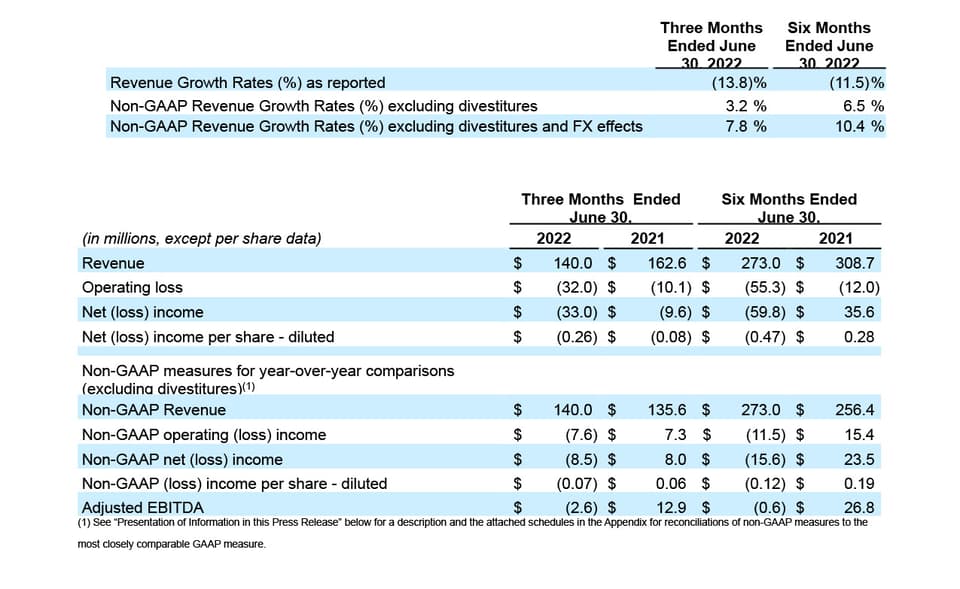

- Q2 2022 revenue of $140.0 million declined 13.8% compared to Q2 2021; Q2 non-GAAP revenue excluding divestitures and on a constant currency basis increased 7.8%, reflecting solid demand in both the Industrial and Healthcare segments despite supply chain and macroeconomic challenges

- First half 2022 revenue of $273.0 million declined 11.5% compared to first half 2021; first half 2022 non-GAAP revenue excluding divestitures and on a constant currency basis increased 10.4%

- Q2 2022 diluted GAAP loss per share of $0.26, and diluted non-GAAP loss per share(1 of $0.07

- Q2 2022 adjusted EBITDA of ($2.6) million reflects inflationary impacts on input costs and continued investments in growth areas of our business and product portfolio

- Cash & short-term investments of $638.2 million position the company for future growth investments

- Reduced FY 2022 guidance reflects the continued risk of foreign exchange, inflation and softer discretionary spending in selected end markets due to macroeconomic challenges

Summary Comments on Results

Commenting on the results, President and CEO, Dr. Jeffrey Graves said, “Our second quarter results came in below our expectations, due in large part to continuing supply chain disruptions that constrained our ability to fill customer orders, input cost inflation that reduced our gross profit margins and a significant negative impact of foreign exchange on our international business. In addition, we are seeing evidence that macro factors are causing selected key customers to spend more cautiously, and we now believe, as reflected in our reduced FY 2022 guidance, that this softer demand environment is likely to continue at least through the balance of the year. We have already taken certain cost and efficiency-related actions and will take additional measures as we move through 2022, with the goal of mitigating the impact of reduced near-term demand on our financial results.”

Dr. Graves continued, “Despite these near-term external pressures which are impacting many companies, I remain extremely confident about the long-term growth drivers for our business and for the additive manufacturing industry. Adoption of additive solutions in production environments continues to move forward, and 3D Systems is at the forefront of this growing trend. The actions we have taken over the last two years have repositioned 3D Systems with an industry-leading portfolio of polymer and metal technologies and a renewed focus on partnering with our customers to create value-added production applications. While the current macroeconomic challenges are clearly pressuring our results, we are confident that we remain well-positioned to achieve the long-term targets that we laid out in our May 2022 Investor Day, including $1 billion in revenue in five years.”

Dr. Graves summarized, “As we have previously noted, we view 2022 as an investment year during which we will add to and refresh our solutions portfolio, build unique capabilities in software and regenerative medicine, and strengthen our corporate infrastructure, all with the goal of supporting strong future growth and profitability by 3D Systems and long-term value for our shareholders.”

Summary of Second Quarter Results

Revenue for the second quarter of 2022 decreased 13.8% to $140.0 million, primarily due to divestitures of non-core businesses during 2021. Non-GAAP revenue excluding divestitures and on a constant currency basis grew 7.8% over the same period last year. The growth of non-GAAP revenue excluding divestitures and on a constant currency basis is primarily due to continued solid product and service demand across both business segments, partially offset by continuing global supply chain disruptions and the Russia-Ukraine war, which has impacted demand in the European region and led to our exit from the Russian market. Industrial revenue decreased 14.3% to $68.3 million compared to the same period last year, however, non-GAAP revenue excluding divestitures and on a constant currency basis increased 11.2% year-over-year. Healthcare revenue decreased 13.4% to $71.7 million, compared to the same period last year. Non-GAAP revenue excluding divestitures and on a constant currency basis increased 4.7% year-over-year.

Gross profit margin in the second quarter of 2022 was 37.9% compared to 42.4% in the same period last year. Gross profit margin decreased primarily due to input cost inflation, supply chain disruptions, higher freight costs, divestitures, and unfavorable product mix.

Operating expenses increased 7.7% to $85.2 million in the second quarter of 2022, compared to the same period a year ago. The higher operating expenses reflect spending in targeted areas to support future growth, including expenses from acquired businesses, research and development, and investments in corporate infrastructure. Also, the Company expensed $11.0 million due to estimated legal costs and other settlements. Non-GAAP operating expenses increased from $48.9 million in Q2 2021 to $60.9 million in Q2 2022. The higher non-GAAP operating expenses reflect spending in targeted areas to support future growth. About half of the increase is from acquired businesses, and the remainder is primarily due to investments in research and development and corporate infrastructure.

Updating 2022 Outlook

3D Systems is lowering its full-year 2022 guidance. The company now expects revenue to be within a range of $530 million to $570 million, reduced from the previous range of $580 million to $625 million. This revenue guidance reflects an estimated $20 million of negative foreign exchange impact, as well as additional negative impacts from reduced customer spending in selected end markets such as dental, elective surgeries and European and Asia Pacific manufacturers caused by the challenging macro-environment. The company expects non-GAAP gross profit margin to be in the range of 39% to 41%. Given its planned investment profile, the company now expects non-GAAP operating expenses to be between $245 million to $250 million. This revised 2022 guidance assumes no significant additional changes in the macroeconomic environment that could negatively impact our business demand or disrupt our supply chain, such as a resurgence of business and/or travel restrictions related to COVID-19, geopolitical events, recession, or foreign exchange rates.

Financial Liquidity

As of June 30, 2022, the company had cash and short-term investments on hand of $638.2 million. Cash and short-term investments have decreased $151.4 million since December 31, 2021, driven primarily by $83.3 million paid for acquisitions and equity investments, cash used in operations of $38.2 million, capital expenditures of $10.4, and other cash used for financing activities of $12.7 million.

Q2 2022 Conference Call and Webcast

3D Systems hosted a conference call and simultaneous webcast to discuss these results. A replay of the webcast will be available approximately two hours after the live presentation at www.3dsystems.com/investor.

For more information, please visit www.3dsystems.com.

Subscribe to our Newsletter

3DPResso is a weekly newsletter that links to the most exciting global stories from the 3D printing and additive manufacturing industry.