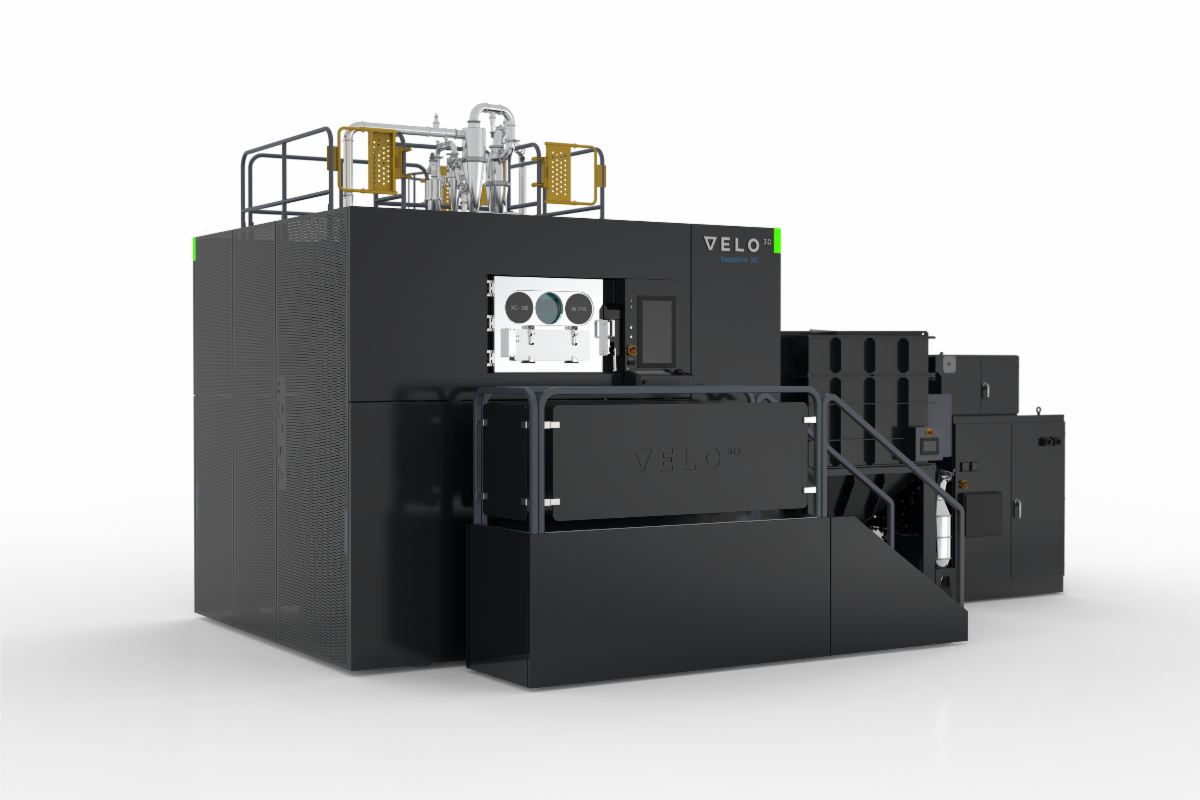

3D printer manufacturer Velo3D recently announced a securities purchase agreement to buy and sell up to $105 million aggregate principal amount of corporate bonds in a registered direct offering (RDO). An RDO allows publicly traded companies to raise capital from a select group of investors.

Velo3D plans to issue bonds in an aggregate principal amount of $70 million at the initial closing of the offering on or about Aug. 14. In addition, investors have been granted the right to purchase up to $35 million in additional bonds. Velo3D expects to receive net proceeds of approximately $66 million from the initial closing, with approximately $22 million to be used to retire existing debt with Silicon Valley Bank. The remaining funds are expected to be used for working capital, capital expenditures and general corporate purposes.

This funding decision follows the release of Velo3D’s Q2 results for 2023, which showed the company falling short of its revenue expectations. The bonds are being offered at an initial conversion rate of 475.1722 shares of the company’s common stock per $1,000 principal amount of bonds. The initial conversion price represents a premium of approximately 15% over the closing price of the Company’s common stock on August 9, 2023. The conversion price and conversion rate may be adjusted under certain conditions.

Velo3D had announced in March 2021 its decision to list on the New York Stock Exchange through a SPAC with JAWS Spitfire Acquisition Company at an enterprise value of approximately $1.6 billion. Today, the company’s market capitalization is $348.44 million with a share value of $1.81. More details on the company’s registered direct offering are available on the company’s website.

Subscribe to our Newsletter

3DPResso is a weekly newsletter that links to the most exciting global stories from the 3D printing and additive manufacturing industry.