Materialise NV (NASDAQ:MTLS), a provider of additive manufacturing and medical software and of sophisticated 3D printing services, announced its financial results for the second quarter ended June 30, 2022.

Highlights – Second Quarter 2022

- Total revenue increased 14.5% to 58,070 kEUR compared to 50,713 kEUR for the second quarter of 2021.

- Total deferred revenue from annual software sales and maintenance fees increased by 3,758 kEUR to 38,903 kEUR compared to December 31, 2021.

- Adjusted EBITDA was 4,240 kEUR, compared to 6,925 kEUR for the 2021 period.

- Net profit for the second quarter of 2022 was 896 kEUR, or 0.02 EUR per diluted share, compared to 3,367 kEUR, or 0.06 EUR per diluted share, for the 2021 period.

Executive Chairman Peter Leys commented, “Demand for the products and solutions of each of our three segments remained strong in these uncertain macro-economic times. Materialise’s revenue increased by almost 15% compared to the same period last year and our deferred revenue from annual software sales and maintenance fees increased by more than 10% compared to December 31,2021. Encouraged by our solid top-line results, we are continuing to execute on our plan of investing in our growth businesses. As a result of inflation and, in particular, our increased labor costs, our Adjusted EBITDA for the quarter was 4,240 kEUR compared to 6,925 kEUR for the second quarter of 2021.”

Second Quarter 2022 Results

Total revenue for the second quarter of 2022 increased 14.5% to 58,070 kEUR from 50,713 kEUR for the second quarter of 2021. Adjusted EBITDA amounted to 4,240 kEUR for the second quarter of 2022 compared to 6,925 kEUR for the 2021 period. The Adjusted EBITDA margin (Adjusted EBITDA divided by total revenue) for the second quarter of 2022 was 7.3%, compared to 13.7% for the second quarter of 2021.

Revenue from our Materialise Software segment increased 6.1% to 10,642 kEUR for the second quarter of 2022 from 10,032 kEUR for the same quarter last year. Segment EBITDA decreased, including the effect of ongoing investments in Link3D, to 821 kEUR from 3,129 kEUR while the segment EBITDA margin was 7.7% compared to 31.2% for the prior-year period.

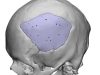

Revenue from our Materialise Medical segment increased 18.9% to 20,855 kEUR for the second quarter of 2022 compared to 17,544 kEUR for the same period in 2021. Segment EBITDA amounted to 4,474 kEUR for the second quarter of 2022 compared to 4,519 kEUR while the segment EBITDA margin was 21.5% compared to 25.8% for the second quarter of 2021.

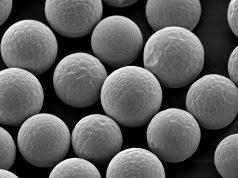

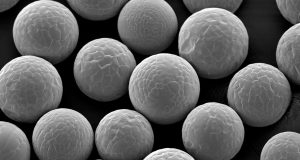

Revenue from our Materialise Manufacturing segment increased 14.2% to 26,574 kEUR for the second quarter of 2022 from 23,268 kEUR for the second quarter of 2021. Segment EBITDA amounted to 1,581 kEUR compared to 1,850 kEUR for the same period last year, while the segment EBITDA margin was 5.9% compared to 8.0% for the second quarter of 2021.

Gross profit was 32,030 kEUR compared to 28,441 kEUR for the same period last year, while gross profit as a percentage of revenue decreased to 55.2% compared to 56.1% for the second quarter of 2021.

Research and development (“R&D”), sales and marketing (“S&M”) and general and administrative (“G&A”) expenses increased, in the aggregate, 25.1% to 33,613 kEUR for the second quarter of 2022 from 26,863 kEUR for the second quarter of 2021.

Net other operating income was 498 kEUR compared to 843 kEUR for the second quarter of 2021.

Operating result amounted to (1,084) kEUR compared to 2,421 kEUR for the second quarter of 2021.

Net financial result was 2,580 kEUR compared to 1,153 kEUR for the second quarter of 2021.

The second quarter of 2022 contained income tax expenses of (600) kEUR, compared to (207) kEUR in the second quarter of 2021.

As a result of the above, net profit for the second quarter of 2022 was 896 kEUR, compared to 3,367 kEUR for the same period in 2021. Total comprehensive income for the second quarter of 2022, which includes exchange differences on translation of foreign operations, was 771 kEUR compared to 4,344 kEUR for the 2021 period.

At June 30, 2022, we had cash and cash equivalents of 168,133 kEUR compared to 196,028 kEUR at December 31, 2021. Gross debt amounted to 90,474 kEUR, compared to 99,107 kEUR at December 31, 2021. As a result, our net cash position (cash and cash equivalents less gross debt) was 77,659 kEUR, a decrease of 19,262 kEUR, and included the effect of our call option exercise to acquire 100% of the shares of Link3D.

Cash flow from operating activities for the second quarter of the year 2022 was 8,636 kEUR compared to 8,871 kEUR for the same period in 2021. Total capital expenditures for the second quarter of 2022 amounted to 6,548 kEUR.

Net shareholders’ equity at June 30, 2022 was 234,921 kEUR compared to 232,577 kEUR at December 31, 2021.

2022 Guidance

Mr. Leys concluded, “The consecutive revenue growth posted by each of our segments in the first and second quarters of this year strengthens our confidence that our full year 2022 revenues will be at least 10% higher than in 2021. While inflation and effects of the war for talent, which are higher and more persistent than anticipated in the beginning of this year, weigh on our results, we continue to invest in our growth businesses. As a result, we currently expect that our consolidated EBITDA for the full year 2022 will be in the range of 20 mEUR to 25 mEUR.”

Non-IFRS Measures

Materialise uses EBITDA and Adjusted EBITDA as supplemental financial measures of its financial performance. EBITDA is calculated as net profit plus income taxes, financial expenses (less financial income), shares of profit or loss in a joint venture and depreciation and amortization. Adjusted EBITDA is determined by adding share-based compensation expenses, acquisition-related expenses of business combinations, impairments and revaluation of fair value due to business combinations to EBITDA. Management believes these non-IFRS measures to be important measures as they exclude the effects of items which primarily reflect the impact of long-term investment and financing decisions, rather than the performance of the company’s day-to-day operations. As compared to net profit, these measures are limited in that they do not reflect the periodic costs of certain capitalized tangible and intangible assets used in generating revenues in the company’s business, or the charges associated with impairments. Management evaluates such items through other financial measures such as capital expenditures and cash flow provided by operating activities. The company believes that these measurements are useful to measure a company’s ability to grow or as a valuation measurement. The company’s calculation of EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies. EBITDA and Adjusted EBITDA should not be considered as alternatives to net profit or any other performance measure derived in accordance with IFRS. The company’s presentation of EBITDA and Adjusted EBITDA should not be construed to imply that its future results will be unaffected by unusual or non-recurring items.

Exchange Rate

This document contains translations of certain euro amounts into U.S. dollars at specified rates solely for the convenience of readers. Unless otherwise noted, all translations from euros to U.S. dollars in this document were made at a rate of EUR 1.00 to USD 1.0387, the reference rate of the European Central Bank on June 30, 2022.

Conference Call and Webcast

Materialise held a conference call and simultaneous webcast to discuss its financial results for the second quarter of 2022 on Thursday, July 28, 2022, at 8:30 a.m. ET/2:30 p.m. CET. Company participants on the call included Wilfried Vancraen, Founder and Chief Executive Officer; Peter Leys, Executive Chairman; and Johan Albrecht, Chief Financial Officer.

For more information, please visit www.materialise.com.

Subscribe to our Newsletter

3DPResso is a weekly newsletter that links to the most exciting global stories from the 3D printing and additive manufacturing industry.