- Revenue grew 38% over prior-year second quarter to $11.8 million, achieving a second quarter record

- First half revenue up 32% to record level, maintaining strong growth driven by indirect machine sales

- Operating leverage demonstrated by gross margin of 30% and 27% in second quarter and first half, respectively

- Backlog of $19.5 million, up $3.1 million over sequential first quarter

- Cash balance increases to $31.9 million

NORTH HUNTINGDON, Pa., Aug. 09, 2016 (GLOBE NEWSWIRE) — The ExOne Company (NASDAQ:XONE) (“ExOne” or “the Company”), a global provider of three-dimensional (“3D”) printing machines and 3D printed and other products, materials and services to industrial customers, reported financial results today for the second quarter ended June 30, 2016.

S. Kent Rockwell, Chairman and Chief Executive Officer, commented, “We’re pleased to have realized record revenue in both the second quarter and the first half of 2016, driven by sales of our larger indirect machines. We continue to see stronger acceptance of our technology through further machine productivity enhancements and broadened material choices, as desired by our industrial customers. Additionally, our growing backlog and pipeline set us up well for ongoing revenue growth in the second half of 2016.”

He added, “Our efforts to lower our breakeven point have resulted in reduced overhead and have improved our cost structure. Positive cash flow and operating leverage on higher revenue is evident in our current quarter financial performance. Our plan is to continue to turn our backlog and grow our revenue, with the goal to achieve sustainable profitability.”

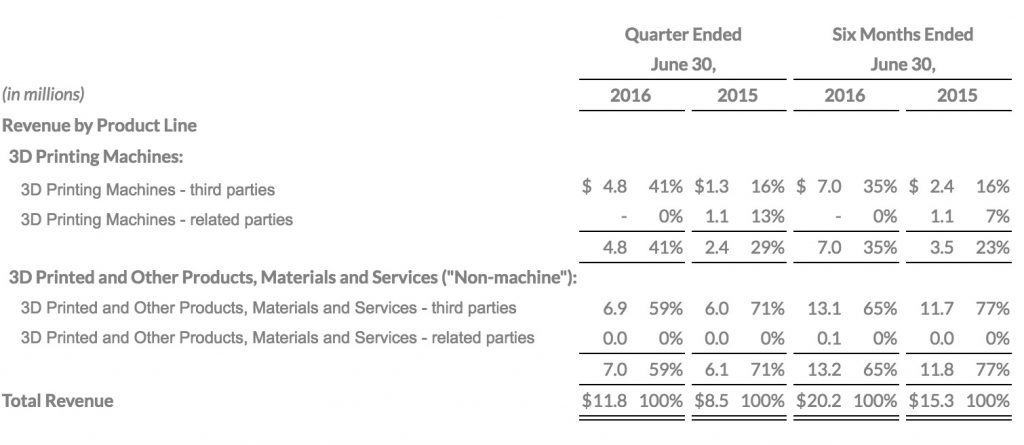

Second Quarter and First Half Revenue — Machine Revenue ~ Doubles for Both Periods

Consolidated revenue for the 2016 second quarter was up 38% compared with the prior-year period. Machine revenue nearly doubled and non-machine revenue grew 15%. The non-machine revenue included approximately $0.5 million from the sale of remaining inventories associated with the Company’s former laser micromachining production line.

For the first half of 2016, revenue was up 32% over the 2015 first half, driven by the same factors that impacted the quarter. Machine revenue nearly doubled and non-machine revenue grew 12%.

Given the long sales cycle and significance of a machine’s average selling price relative to total revenue, fluctuations in machine-sale revenue vary from quarter to quarter. ExOne does not believe that such quarter-to-quarter fluctuations are necessarily indicative of larger trends.

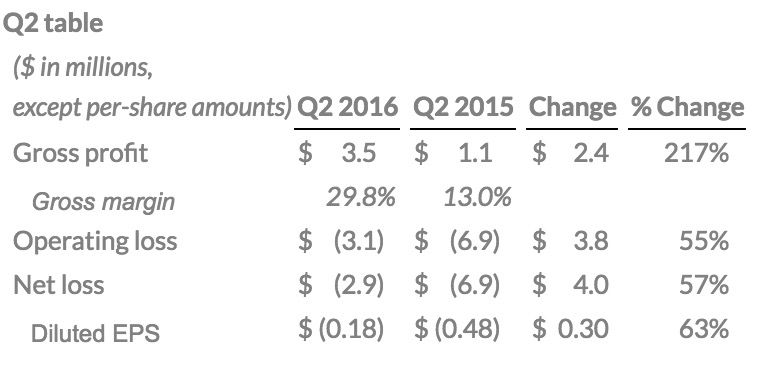

Second Quarter Operations — Operating Leverage on Higher Revenue

The increase in second quarter gross profit was driven by higher revenue, including significantly higher machine sales and a favorable mix of indirect machines, as well as the reversal of a $0.5 million reserve for obsolete and slow-moving inventory, and enhanced production efficiency. The 2015 quarter was impacted by inefficiencies resulting from the Company’s transition into its new and expanded facilities as well as deployment of its ERP system.

Operating loss for the quarter significantly improved compared with the prior-year second quarter due to higher gross profit as well as lower selling, general and administrative (“SG&A”) expenses. SG&A decreased by 26% to $4.7 million compared with $6.3 million in the prior-year quarter, primarily due to lower bad debt, professional, consulting and trade show expenses. R&D expenses of $1.9 million for the quarter were up from $1.7 million in the 2015 second quarter, with the increase reflecting project-related material costs.

Adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”) was a $1.4 million loss in the 2016 second quarter, compared with a $5.2 million loss in last year’s second quarter. ExOne management believes that when used in conjunction with other measures prepared in accordance with accounting principles generally accepted in the United States (“GAAP”), that Adjusted EBITDA, a non-GAAP measure, assists in the understanding of its financial results. See the attached tables for important disclosures regarding the Company’s use of Adjusted EBITDA as well as a reconciliation of net loss to Adjusted EBITDA for the quarters and six months ended June 30, 2016 and 2015.

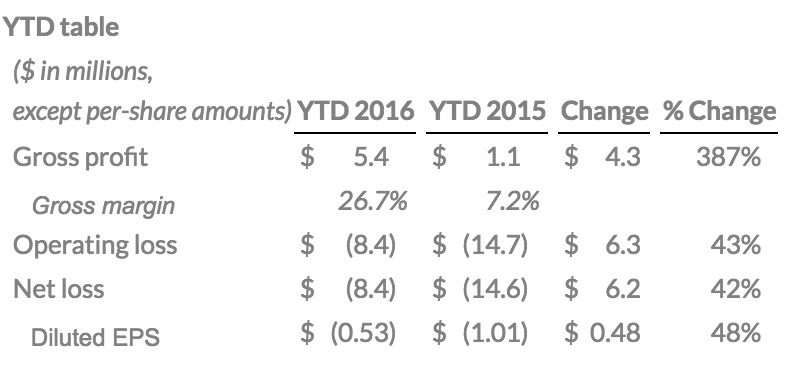

First Half 2016 Review — Gaining Momentum in Operational Performance

Gross profit and gross margin for the 2016 first half significantly improved compared with the prior-year first half. The 2016 period was driven by higher volume, especially indirect machine sales, the reversal of a $0.5 million reserve for obsolete and slow-moving inventory, and improved efficiencies. As noted for the quarter, the 2015 year-to-date period also included costs associated with the Company’s expanded global facilities integration as well as its ERP system implementation.

Operating loss improved for the 2016 first half compared with the 2015 first half primarily due to higher gross profit and lower SG&A expenses. SG&A for the 2016 first half was $10.0 million, down $2.5 million, or 20%, compared with the prior-year period for the similar reasons cited above. R&D expense was $3.8 million in the 2016 first half compared with $3.4 million in the 2015 first half, with the increase reflecting project-related material costs.

Adjusted EBITDA was a $5.0 million loss in the first half of 2016, compared with a $11.4 million loss in last year’s first half. ExOne management believes that when used in conjunction with other measures prepared in accordance with accounting principles generally accepted in the United States (“GAAP”), that Adjusted EBITDA, a non-GAAP measure, assists in the understanding of its financial results. See the attached tables for important disclosures regarding the Company’s use of Adjusted EBITDA as well as a reconciliation of net loss to Adjusted EBITDA for the quarters and six months ended June 30, 2016 and 2015.

Capitalization — Positive Cash Flow Reflects Spending and Working Capital Discipline

Cash and cash equivalents as of June 30, 2016 were $31.9 million, up from $31.3 million at March 31, 2016 and $19.3 million at December 31, 2015. The increase in cash during the second quarter was driven by improved operating performance and working capital management. Cash provided by operating activities was $0.8 million in the 2016 second quarter and cash used for operating activities was $0.2 million year-to-date. Cash used for operating activities during the second quarter and first half of 2015 was $4.0 million and $8.1 million, respectively. Cash capital expenditures were $0.3 million for the first half of 2016 compared with $2.8 million for the first half of 2015.

About ExOne

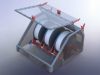

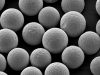

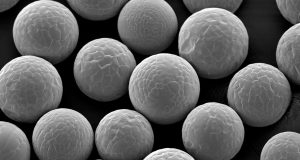

ExOne is a global provider of 3D printing machines and 3D printed and other products, materials and services to industrial customers. ExOne’s business primarily consists of manufacturing and selling 3D printing machines and printing products to specification for its customers using its in-house 3D printing machines. ExOne’s machines serve direct and indirect applications. Direct printing produces a component; indirect printing makes a tool to produce a component. ExOne offers pre-production collaboration and print products for customers through its network of PSCs. ExOne also supplies the associated materials, including consumables and replacement parts, and other services, including training and technical support that is necessary for purchasers of its 3D printing machines to print products.

Subscribe to our Newsletter

3DPResso is a weekly newsletter that links to the most exciting global stories from the 3D printing and additive manufacturing industry.